Domestic Abuse Victims Can Now Use Retirement Savings to Rebuild Their Lives

Domestic abuse can shatter its victims in many ways, financially being one of them. In the United States, many women are left with no option but to stay with their abusers due to economic dependence. However, the government’s recent decision to allow domestic abuse victims to withdraw up to $10,000 or 50% of their account balance.

The best part? Victims will be able to able this amount without penalty, which could bring considerable relief to survivors. Not only does it enable financial independence, though, but it also helps them start over after the traumatic experiences.

Pavel / Pexels | According to Secure 2.0, aspiring retirees can withdraw 50% of their retirement savings to combat domestic abuse. All without any penalties.

The Reality of Domestic Abuse in the U.S.

Domestic abuse affects a significant number of Americans each year. Reports show that 1 in 4 women and 1 in 9 men are victims of intimate partner violence, according to the National Domestic Violence Hotline.

Survivors of domestic abuse can experience financial barriers when trying to leave their abusers. Why? Well, simply because they may have limited access to their finances and may be economically dependent on their partner, leaving them without resources to start over. The ability to access retirement savings could be a game-changer for domestic abuse survivors.

RDNE / Pexels / According to the National Domestic Violence Hotline, 1 in 4 women are subject to domestic abuse in the U.S.

The Benefits of the New Law

The new law allows domestic abuse survivors to take out funds from their retirement accounts without penalty. This includes 401(k)s, traditional IRAs, and other qualified retirement savings accounts. With this change, survivors will be able to take control of their finances. And make choices designed to leverage their financial resources toward long-term stability.

By accessing their retirement savings, survivors have the choice to save money from interest and reinvest that money to fund their future goals and prepare for the future.

The Timing of the Law

Domestic violence cases have surged globally during the Covid-19 pandemic. And this new law comes at a time when victims need it the most. Survivors who end up leaving or who have left an abuser during the pandemic can use the funds to rebuild their lives. They can stabilize housing, pay for legal help, and cover urgent costs that will help rebuild their independence.

Pixabay / Pexels / According to early reports, the Secure 2.0 reforms will be operational by early 2024.

The Challenges

While this new law is a bright spot in the fight for gender equality, there are still challenges that need to be addressed. One of the most significant challenges is that many abuse victims may not have sufficient savings to draw on.

However, continuing the fight for domestic abuse awareness and financial education remains essential to ensure these changes benefit the victims who need it most.

Thus, the ability to withdraw funds from retirement accounts without any penalty is a life-changing and empowering tool for domestic abuse survivors. Survivors can use this to gain financial independence and choose their futures without being reliant on their abusers.

More in Criminal Attorney

-

A Step-By-Step Guide to Becoming a Real Estate Lawyer

A real estate lawyer specializes in legal matters related to property, from transactions to disputes. They ensure legality in real estate...

December 3, 2023 -

What Is Asylum & How Does It Work?

At its core, asylum is a protection granted to foreign nationals in a country because they have suffered persecution or have...

November 26, 2023 -

6 Reasons Why Sentencing Is Any Judge’s Toughest Assignment

When you picture a judge, you might imagine a stern figure in black robes, gavel in hand, delivering verdicts with unwavering...

November 14, 2023 -

Carrie Underwood Sued for NBC Sunday Night Football’s “Game On”

It is almost ritualistic. As the weekend winds down and Sunday evening approaches, millions across America gear up for a night...

November 12, 2023 -

Why Lawyers’ Productivity Has Increased in Modern Times

Remember the old days when your image of a lawyer might have been drawn straight out of an episode of “Matlock”...

November 5, 2023 -

Paying Down Debts Using Debt Relief Tactics

Debt is like that lingering headache that never seems to go away, no matter how much aspirin you pop. But there...

October 29, 2023 -

Pro Se: Your Right to Represent Yourself WITHOUT an Attorney

The legal system is complex and so, more often than not, people hire a professional attorney to navigate the legal system....

October 21, 2023 -

The Craziest, Most Expensive Hollywood Divorces of All Time

Hollywood is the land of glitz, glamour, and romance – until it is not. Over the years, we have seen our...

October 13, 2023 -

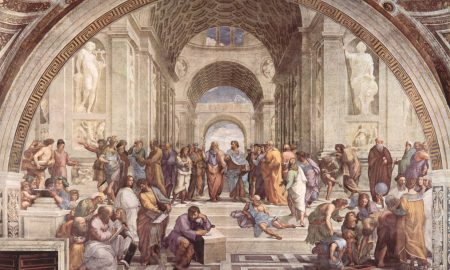

How Was Life as a Lawyer in Ancient Rome?

The Late Roman Republic was a period chock-full of political drama, rampant corruption, and the rise and fall of powerful figures....

October 8, 2023